The Case for Bitcoin

A few good articles on bitcoin and some good podcasts at the end.

Executive Order 6102 by Heavily Armed Clown (@heavilyarmedc)

The significance of Executive Order 6102 was not just that individuals could no longer own gold, but more specifically, that they could no longer redeem bank notes for gold. This was an indefinite disruption of the settlement to the base layer of money.

Historically, when banks engaged in fractional expansion of their promissory notes a time period of liquidation would bring them back to reality. Liquidation in this sense means settlement back to the base layer (gold).

After a period of liquidation (settlement back to the base layer) a bank that was still solvent (either by prudent financial management or by faith of the market) got to carry on.

Every major financial crisis in the US had a common theme…

Periods of bank note expansion (usually driven by government debt expansion and rampant private enterprise speculation following large government subsidy, such as railroads) followed by a snap liquidation of mal-investment. By settling back down to the base layer money…

A common strategy of the US government throughout every major financial panic in the 19th century was to temporarily arrest this process of liquidation (or redemption of bank notes for specie).

The reason for this, is that these banks were the primary holders of US government bonds, and the government relied on their solvency to continue borrowing and spending. The significance of EO 6102 was that it was an indefinite suspension of settlement to the base layer.

The term "Fiat" money is often misconstrued because people don’t know this history. The fiat (order or decree) aspect of the money was that their face value would remain as it was when backed by redeemable specie without the ability for the market to settle to the base layer.

Settlement to the base layer (for the next 50ish years) was reserved for sovereign nations under Bretton Woods, and ultimately ended in 1971, for much the same reasons suspension of redemption of specie occurred throughout the 19th century. An arrest of liquidation.

Settlement to the base layer of money is a CRUCIAL process in the trust instilled by the market into financial institutions. Without this settlement, financial institutions (and more particularly currency issuance parties) are little more than Mafias…

Mafias which dictate the terms of economic calculation and manipulate the underlying reality of the aggregate wealth of society. As the world moves beyond the long tail paradigm of fiat central banking, a new system should be envisioned. One in which the settlement to the base layer is a RIGHT retained to every individual. In this way, the market will decide who is whole and who is not, instead of bureaucrats who curry backroom deals in favor of special interests. A monetary system built on a distributed global consensus of software which settles on the base layer in finality, and the degrees of that assurance being set according to market demand. A system of transparency in which reserves at the base layer can be audited by anyone and claimed whenever a period of liquidation arises.

Money is not a belief system. It is a concrete network mechanism of trust in the underpinnings of voluntary exchange in a society. And settlement to the base layer is necessary to retain that trust in the process of mutually beneficial cooperation.

Bullish Case for Bitcoin

A good article about the bullish case for bitcoin

Acquiring a good in hopes that it will be demanded as a future store of value hastens its adoption for that very purpose

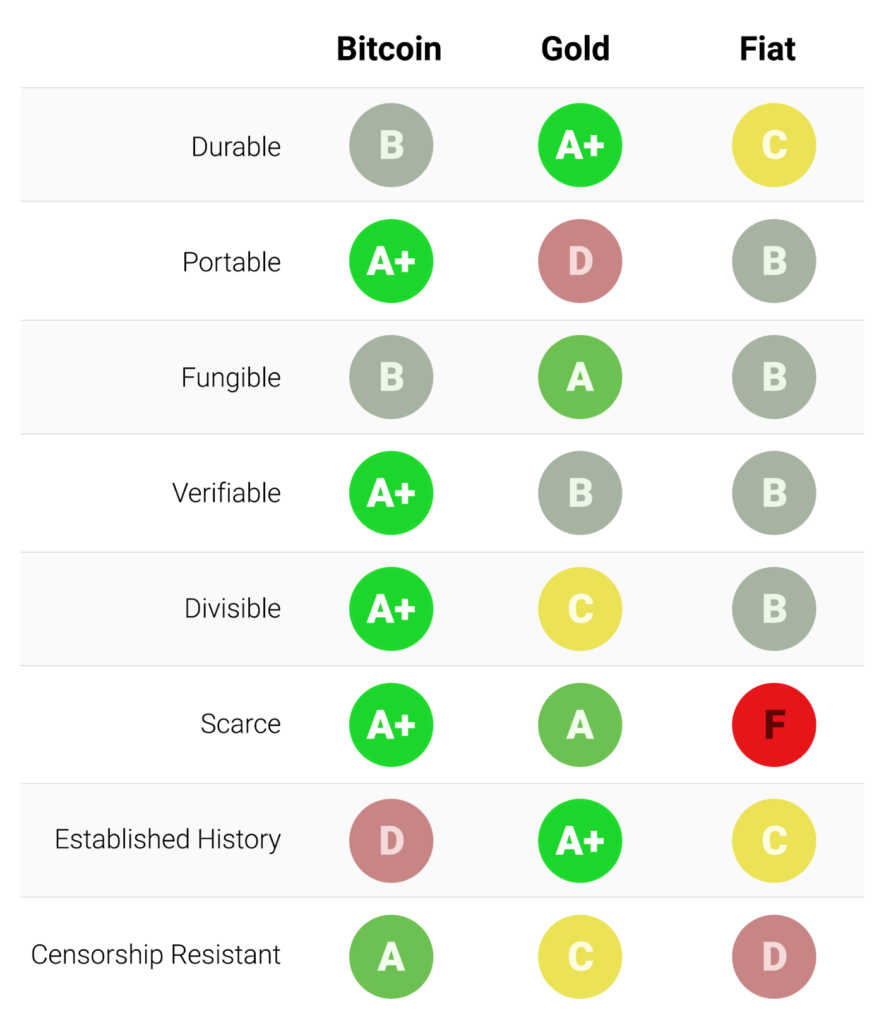

Fiat currency and bitcoins are fundamentally digital records that may take physical form (such as paper bills)

Bitcoins, having no issuing authority, may be considered durable so long as the network that secures them remains in place

bitcoins are traceable on the blockchain, a particular bitcoin may become tainted by its use in illicit trade and merchants or exchanges may be compelled not to accept such tainted bitcoins.

Using cryptographic signatures, the owner of a bitcoin can publicly prove she owns the bitcoins she says she does.

By design, at most 21 million bitcoins can ever be created…

For instance, an owner of 10 bitcoins would know that at most 2.1 million people on earth (less than 0.03% of the world’s population) could ever have as many bitcoins as they had.

From their inception, fiat currencies have had a near-universal tendency toward eventual worthlessness

The use of inflation as an insidious means of invisibly taxing a citizenry has been a temptation that few states in history have been able to resist.

While it is true that a sufficiently careful and diligent person can conceal their identity when using Bitcoin, this is not why Bitcoin was so popular for trading drugs. The key attribute that makes Bitcoin valuable for proscribed activities is that it is “permissionless” at the network level. When bitcoins are transmitted on the Bitcoin network, there is no human intervention deciding whether the transaction should be allowed.

Evolution of Money

Many have criticized Bitcoin as being an unsuitable money because its price has been too volatile to be suitable as a medium of exchange

Historically speaking … gold seems to have served, firstly, as a commodity valuable for ornamental purposes; secondly, as stored wealth; thirdly, as a medium of exchange; and, lastly, as a measure of value

money stages:

- Collectible

- Store of value

- Medium of exchange

- Unit of account

Monetary goods that are not yet a unit of account may be thought of as being “partly monetized”. Today gold fills such a role, being a store of value but having been stripped of its medium of exchange and unit of account roles by government intervention.

The truth is that the notions of “cheap” and “expensive” are essentially meaningless in reference to monetary goods. The price of a monetary good is not a reflection of its cash flow or how useful it is but, rather, is a measure of how widely adopted it has become for the various roles of money.

it is entirely rational for the individual owner to evangelize for a superior monetary good and for society as a whole to standardize on it…

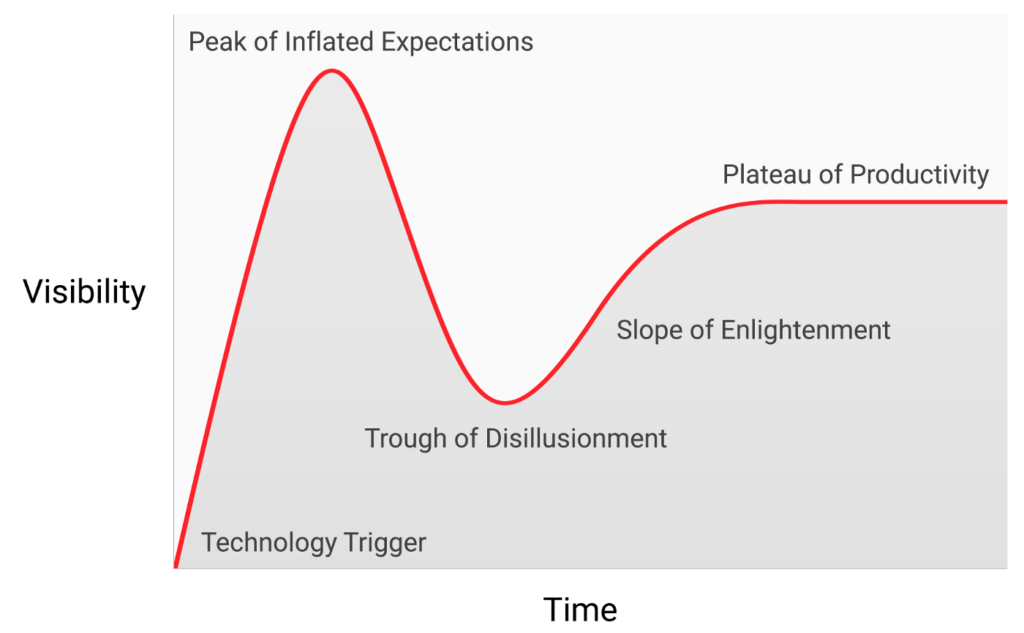

Apparently the bitcoin price is a fractal resembling this shape – a Gartner hype cycle.

Gold and Bitcoin would have equivalent market capitalizations at a bitcoin price of approximately $380,000 at the time of writing…

Hyperinflation

When a sovereign money hyperinflates, its value first collapses against the most liquid goods in the society, such as gold or a foreign money like the US dollar, if they are available.

The ability to easily transmit bitcoins across borders and absence of a need for a banking system make Bitcoin an ideal monetary good to acquire for those afflicted by hyperinflation.

Transaction fees Too High

A recent criticism of the Bitcoin network is that the increase in fees to transmit bitcoins makes it unsuitable as a payment system.

When the 21 million are mined – there will be no incentive to continue verifying transactions.

Transaction fees are the cost required to pay bitcoin miners to secure the network by validating transactions. Miners can either be paid by transaction fees or by block rewards, which are an inflationary subsidy borne by current bitcoin owners.

A network with “low” fees is a network with little security and prone to external censorship. Those touting the low fees of Bitcoin alternatives are unknowingly describing the weakness of these so-called “alt-coins”.

Only when Bitcoin has become a deeply established store of value will it become suitable as a medium of exchange

Further, once the opportunity cost of trading bitcoins is at a level at which it is suitable as a medium of exchange, most trades will not occur on the Bitcoin network itself but on “second layer” networks with much lower fees.

Second layer networks, such as the Lightning network, provide the modern equivalent of the promissory notes that were used to transfer titles for gold in the 19th century.

A common investment criticism of Bitcoin is that it cannot maintain its value when competitors can be easily created that are able to incorporate the latest innovations and software features.

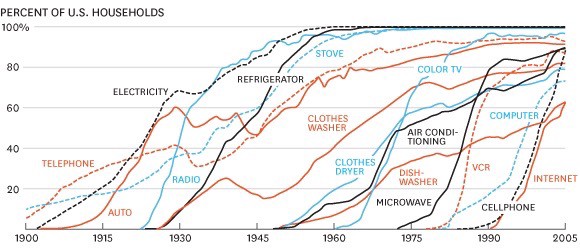

A network effect — the increased value of using Bitcoin simply because it is already the dominant network — is a feature in and of itself. For any technology that possesses a network effect, it is by far the most important feature.

Forking

By copying Bitcoin’s blockchain up to a certain point and then splitting off into a new network, in a process known as “forking”, competitors to Bitcoin were able to solve the problem of distributing their token to a large user base.

The majority of the market capitalization will settle on the network that retains the highest-calibre and most active developer community.

Real Risks

Protocol Risks

Breaking of the cryptography underpinning Bitcoin…

Exchange Risks

Exchanges where bitcoins are traded for fiat currencies are highly centralized and susceptible to regulation and closure…

Although local exchanges and over the counter exists…the critical process of price discovery happens on the most liquid exchanges, which are all centralized.

Fungibility

if regulations were to appear that banned the use of such tainted bitcoins by exchanges or merchants, they could become largely worthless…

Shelling Out – Nich Szabo

In a population of cheaters and suckers, the cheaters always win. However, sometimes animals come to cooperate through repeated interactions and a strategy called Tit-for-Tat: start cooperating and keep cooperating until the other party cheats – then defect yourself. This threat of retaliation motivates continued cooperation.

Dawkins suggests, "money is a formal token of delayed reciprocal altruism"

The need to remember faces and favors is a major cognitive hurdle, but one that most humans find relatively easy to overcome. Recognizing faces is easy, but remembering that a favor took place when such memory needs to be recalled can be harder. Remembering the specifics about a favor that gave it a certain value to the favored is harder still. Avoiding disputes and misunderstandings can be improbable or prohibitively difficult.

The appraisal or value measurement problem is very broad. For humans it comes into play in any system of exchange – reciprocation of favors, barter, money, credit, employment, or purchase in a market. It is important in extortion, taxation, tribute, and the setting of judicial penalties. It is even important in reciprocal altruism in animals. Consider monkeys exchanging favors – say pieces of fruit for back scratches. Mutual grooming can remove ticks and fleas that an individual can’t see or reach. But just how much grooming versus how many pieces of fruit constitutes a reciprocation that both sides will consider to be "fair", or in other words not a defection? Is twenty minutes of backscratching worth one piece of fruit or two? And how big a piece?

For the vast majority of potential exchanges, the measurement problem is intractable for animals. Even more than the easier problem of remembering faces and matching them to favors, the ability of both parties to agree with sufficient accuracy on an estimate of the value of a favor in the first place is probably the main barrier to reciprocal altruism among animals.

Nineteenth century economist Carl Menger first described how money evolves naturally and inevitably from a sufficient volume of commodity barter.

Barter requires a coincidence of interests.

Barter doesn’t scale

Money reduced the need for credit in small bartering agreements.

The primary and ultimate evolutionary function of collectibles was as a medium for storing and transferring wealth.

People, clans or tribes trade voluntarily because both sides believe they gain something.

Starvation Insurance

Food is worth far more to starving people than to well fed ones.

If the starving man can save his life by trading his most precious valuables, it may be worth to him months or even years of the labor it might take to replace that value.

Large wild animals unafraid of humans no longer exist

Either driven extinct or learnt to be afriad of humans and our projectiles in the Paleolithic period.

The necklaces, flints, and any other objects used as money circulate in a closed loop, back and forth, in roughly equal amounts so long as the value of meat traded remains roughly equal. Note that it is not enough, for the theory of collectibles put forth in this paper to be correct, that single beneficial trades were possible. We must identify closed loops of mutually beneficial trades. With closed loops the collectibles continue to circulate, amortizing their costs.

The Family Trade

Parental investment is a long-term and almost one-shot affair – there is no time for repeated interactions. Divorce from a negligent father or unfaithful wife usually represented several years of time wasted, in genetic fitness terms, by the jilted party. Fidelity and commitment to the children were primarily enforced by in-laws – the clan. The marriage was the contract between clans that usually included such promises of fidelity and commitment as well as wealth transfer.

The Spoils of War

When two neighboring tribes were not at war, one was usually paying tribute to the other. Tribute could also serve to bind alliances, achieving economies of scale in warfare. Mostly, it was a form of exploitation more lucrative to the victor than further violence against the defeated.

Hiding and other strategies presented a problem that tribute collectors share with modern tax collectors – how to estimate the amount of wealth they can extract.

On the Laffer Curve and theBastards Taxing Us

Imagine a tribe collecting tribute from several neighbor tribes it previously defeated in war. It must estimate how much it can extract from each tribe. Bad estimates leave the wealth of some tribes understated, while forcing others to pay tribute based on estimates of wealth they don’t actually have. The result: the tribes that are hurt tend to shrink. The tribes that benefit pay less tribute than could be extracted. In both cases, less revenue is generated for the victors than they might be able to get with better rules. This is an application of the Laffer curve to the fortunes of specific tribes. On this curve, applied to income taxes by the brilliant economist Arthur Laffer, as the tax rate increases, the amount of revenue increases, but at an increasingly slower rate than the tax rate, due to increased avoidance, evasion, and most of all disincentive to engage in the taxed activity. At a certain rate due to these reasons tax revenues are optimized. Hiking the tax rate beyond the Laffer optimum results in lower rather than higher revenues for the government. Ironically, the Laffer curve was used by advocates for lower taxes, even though it is a theory of tax collection optimum to government revenue, not a theory of tax collection optimal to social welfare or individual preference satisfaction.

From that day to this, government mints with self-granted monopolies, rather than private mints, have been the main issuers of coin.

Only governments could enforce anti-counterfeiting measures.

Most pre-modern cultures decided that payment was better than punishment

Conclusion

To be useful as a general-purpose store of wealth and means of wealth transfer, a collectible had to be embedded in at least one institution with a closed-loop cycle, so that the cost of discovering and/or manufacturing the object was amortized over multiple transactions

The Case for $500K Bitcoin – Tyler Winklevoss

Gold and oil have historically been reliable stores of value. Because they are scarce commodities, they make dependable hedges to the inflation of fiat currencies. As a result, they have commanded price premiums above and beyond the demand for their consumption alone.

Modeling Bitcoin Value with Scarcity

"As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong [..], not useful for any practical or ornamental purpose .. and one special, magical property: can be transported over a communications channel" — Nakamoto

Bitcoin has unforgable costliness, because it costs a lot of electricity to produce new bitcoins. Producing bitcoins cannot be easily faked. Note that this is different for fiat money and also for altcoins that have no supply cap, have no proof-of-work (PoW), have low hashrate, or have a small group of people or companies that can easily influence supply etc.

Bitcoin currently has a stock of 17.5m coins and supply of 0.7m/yr = SF 25. This places bitcoin in the monetary goods category like silver and gold. Bitcoin’s market value at current prices is $70bn.

Gold has the highest SF 62, it takes 62 years of production to get current gold stock

Supply of bitcoin is fixed. New bitcoins are created in every new block. Blocks are created every 10 minutes (on average), when a miner finds the hash that satisfies the PoW required for a valid block.

The first transaction in each block, called the coinbase, contains the block reward for the miner that found the block.

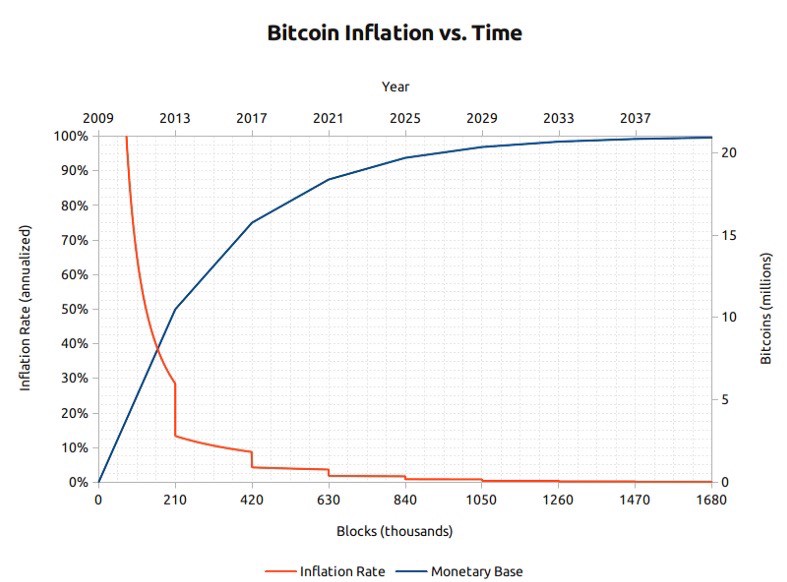

The subsidy started at 50 bitcoins, and is halved every 210,000 blocks (about 4 years). That’s why ‘halvings’ are very important for bitcoins money supply and SF. Halvings also cause the supply growth rate (in bitcoin context usually called ‘monetary inflation’) to be stepped and not smooth

Atricle (to read)

Why The Yuppie Elite Dismiss Bitcoin

https://www.citadel21.com/why-the-yuppie-elite-dismiss-bitcoin

A great simple explanation why people you think are smart – won’t get bitcoin.

They are served and serve the system, they trust the system and cannot face that the system is built on debt.

They also believe they are the people in the know – snobs

Yuppies have to verify – they cannot merely trust. However they are not willing to put in the hard word, research and persistence.

They are also kiss asses and only want to impress their own yuppie friends they rub shoulders with.

Haha, fuck ’em.

Social Scalability

https://nakamotoinstitute.org/money-blockchains-and-social-scalability/

The more an institution depends on local laws, customs, or language, the less socially scalable it is.

The nonexistence of complete trustlessness is true even of our strongest security technology, encryption. Although some cryptographic protocols do guarantee certain specific data relationships with astronomically high probability against opponents with astronomically high computing power, they do not provide complete guarantees when accounting for all possible behaviors of all participants.

Markets and money involve matchmaking (bringing together buyer and seller), trust reduction (trusting in the self-interest rather than in the altruism of acquaintances and strangers), scalable performance (via money, a widely acceptable and reusable medium for counter-performance), and quality information flow (market prices).

It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard for their own interest. – Adam Smith

Charts and Lists

Gradually, Then Suddenly

https://unchained.com/blog/dollar-crisis-to-bitcoin/

Mentions The Use of Knowledge in Society – Hayey…well worth a read.

Bitcoin’s Habitats

https://dergigi.com/2020/03/01/bitcoin-s-habitats/

Bitcoin: The Expert Keynesian Alternative

https://bitcoinmagazine.com/business/debt-of-nations-alternative-to-economics

Is it too late?

https://www.swanbitcoin.com/am-i-too-late-for-bitcoin/

The Two Biggest Reasons Why Bitcoin Price Will Reach $1,000,000 Within 20 Years

https://inbitcoinwetrust.substack.com/p/the-two-biggest-reasons-why-bitcoin?s=r

The 7 Pillars of Bitcoin

https://inbitcoinwetrust.substack.com/p/the-seven-pillars-of-bitcoin?s=r

Inside Job Film

Hard Money Film

https://www.hardmoneyfilm.com/

Saylor on Tucker

https://www.youtube.com/watch?v=st3KJN_DzCg&ab_channel=BITCOIN