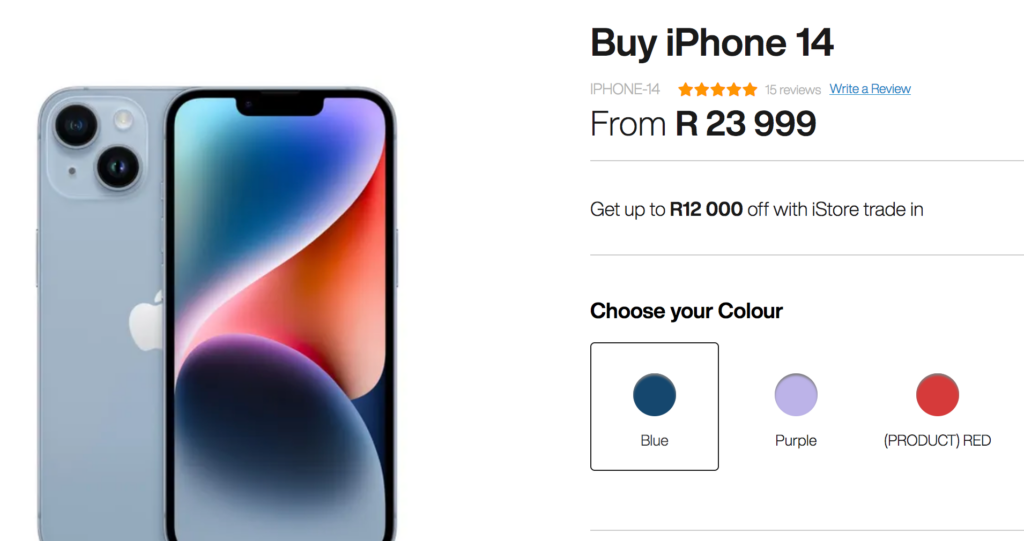

At the time of writing a iPhone 14 256 GB costs: R23999

A third party know as the State – who rules by decree but does no work – steals a portion of every transaction in South Africa.

How much the SA State steals from the Consumer?

To buy a R23999 iphone – one needs R23999. To acquire that amount of money usually one would work – exchange their time, energy and resources for money.

Say there are 3 people:

- A young person who has been in a job under 10 years and is earning R30000 a month.

- A middle aged person who has been in a job 20 years and is earning R60000 a month.

- An older person who has been in a job 30 years and is earning R90000 a month.

Unfortunately – the South African state steals a portion of your earnings – simply because you have earned it and put in the hard work.

What is their fair share of what you have earned? It is zero. You have no say in the matter – tax is not voluntary and is therefore theft.

The amount the State thieves take is stated in this sars rates of tax (theft) for individuals.

How much does the state steal?

- From R30000 it steals: R5130.45 (17.10%)

- From R60000 it steals: R15591 (25.98%)

- From R90000 it steals: R27729 (30.81%)

In order to buy the phone the amount one really needs to earn is much higher. For the different people this is how much R23999 will cost them in their time, energy and resources:

- For the young person: R28102.83

- For the middle aged person: R30473.93

- For the old person: R31393.09

How much has the government stolen in each scenario:

- For the young person: R4103.83

- For the middle aged person: R6474.93

- For the old person: R7394.09

The producer has to sell the product at a higher price to the consumer due to sales tax (or value added tax) – which is also a form of theft from consumers. However it will be taken as theft from producers in this example.

VAT – Value Added Tax – yet no value was ever created by the state. It is the general public that adds the value.

How much the SA State steals from the Consumer?

The state steals from the consumer with sales tax (which they call value-added tax) and with tax on profits.

In this example only sales theft will be examined.

The sales theft rate in south africa is 15%.

On the R23999 iphone, the total amount of theft is: R3599.85.

The producer only gets R20399.15.

What is the total theft by the South African State when an iPhone is bought?

Total = Consumer theft + Producer theft

- Young person: R4103.83 + R3599.85 = R7703.68

- Middle aged person: R6474.93 + R3599.85 = R10074.78

- Old person: R7394.09 + R3599.85 = R10993.94

What is the percentage of theft?

- Young person: 32.1%

- Middle aged person: 41.98%

- Old person: 48.81%

It is staggering to realise that the Government steals 30% to 50% of the value from most transactions of this nature in South Africa.

It is value extraction from the general public – producers and consumers. Taken by force at the threat of violence.

There is a way to opt out…