Update: December 2021

Note: I wrote this some years back. After learning more and listening to more people it is clear that inflation is not a single number. We want to summarise it as a single number but different things will change in value based on their supply and demand which is in turn influenced by trillions of other things.

The inflation myths highlighted by Michael Saylor are:

- Inflation is CPI

- Inflation is a single number

- Inflation is caused only by Monetary Policy

- Inflation is cured by manipulating interest rate

Inflation is a vector

End Update

The biggest expenditures one makes in their lifetime is a house/property, a car and education fees.

Why then are these huge expenditures left out of the regular CPI inflation calculations? I will be clarifying what the real Inflation rate for South Africa is for 2016-2017.

Along with day-to-day expenses things like medical aid increases, house price increase, car price increases, the cost of servicing vehicles, cost of insurance increases and school and education fee increases should be taken into account.

I intend to calculate a more realistic inflation figure.

The basket of Goods and Services with Real Inflation

Remember these are just estimates based on article found on the net.

- New and used car price: 10.5% (2015 average new car price increase: 7.4%)

- Motor vehicle registration and licensing cost: 6%

- House price increases: 6.2%

- Increase in Household Insurance: 9.9% (A real world figure, with no source as I could not find)

- Increase in car insurance: 7% (Ball parking I have no data)

- Increase in car parts/servicing: 14.4% (Based on Polo Vivo difference R56 968 in 2016, R49,805 in 2015)

- Increase in school fees (government schools): 8.15% (average of Government schools)

- Increase in gym fees: 14.9% (Based on Virgin active going from R322 to R370 a month)

- Increase in medical aid 2017: 10.2% (The low end)

- Increase in computer prices (Tech price inflation): 19.59% (Based on 2015-2016 values with Des Van Rooyen) 18.75% on my calculation

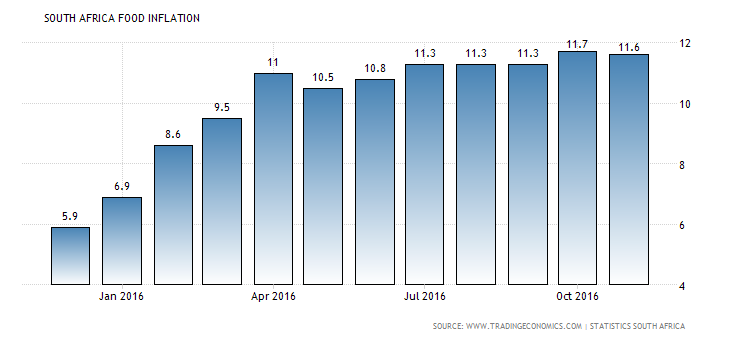

- Food Inflation: 10.4% (Worked out using 11 months Jan 2016 to November 2016)

(source for Food Inflation Chart)

(source for Food Inflation Chart) - Electricity price increase: 7.2% (The low end)

- Rates, Taxes, Sanitation, Refuse and Water: 9.775% (For gauteng an average of the increases)

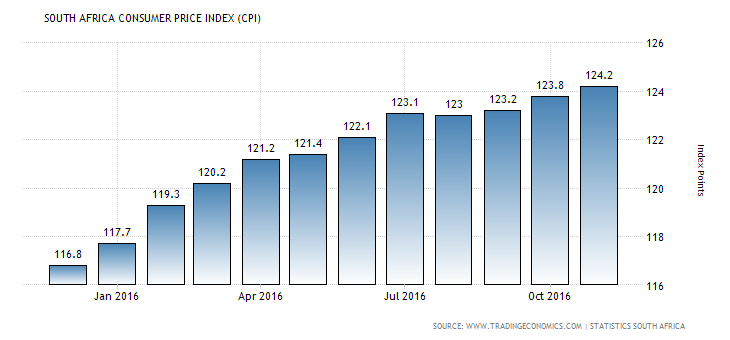

Now we have this figure called the Average CPI Inflation for South Africa for 2016 was 6.56%. From the figures above you can see that this figure is lower than most of the increases shown above.

Now there are some costs that went down for example Milk went down due to a price decrease at one of the major stores (all other stores had to drop to compete) and I am assuming that internet and communication costs will go down (ie. their price will remain constant 0%).

There is also looking from a rental perspective that is likely to remain in the 6-7% band. So we will use that with our house price benchmark. As whether you have a bond or are renting it is a similar expense long term.

Real Inflation Calculation

Now to calculate what the Real Inflation rate for South Africa 2016 – 2017 was we need to look at what we will most likely be spending our salaries on, the percentage and also what we are saving / servicing debt for those massive purchases in our lifetime.

First off most of our salaries go into living expenses. So that is Food, electricity, rates, taxes and sanitation. This is on the lower side but it does not include debt obligations for big purchases.

A big portion goes to just sustaining our livelihood with food and groceries so that gets 30%. Along with household insurance 1%, 1% electricity and the 5% is rates, taxes, sanitation refuse and water. That comes to 37%.

Nb. Transport costs take up much more of the lower income groups salary usage. In this case I will assume a car is purchased, so it makes up for the big expenses.

The other 63% are those big once-off or maintenance purchases. The biggest (most expensive) asset you will probably buy in your lifetime is a house. So we’ll mark that at 30%, as most likely 31% of your entire life’s income up until you buy it will go to paying for a house. School fees at 13% and Car at 8%. Medical aid at 5%, computer at 1% and data at 2% (remember it will not inflate). Gym fees (0.5%), car servicing (1%), car insurance get (1%) and car licensing get 0.5%.

So the final calculation:

Real Inflation = 30%(Food inflation) + 1%(Household Insurance) + 1%(Electricity) +5%(Rates, taxes, sanitation, refuse and water) + 31%(house price increase) + 13%(School fees) + 8%(Car) + 5%(Medical Aid) + 1% (Computer) + 2% (Data) + 0.5% (Gym / Other Hobbie) + 2% (Car service) + 1%(car insurance) + 0.5% (Car licensing)

Lets work this out: The Real Inflation value for South Africa 2016

Real Inflation = 30%(10.4) + 1%(9.9) + 1%(7.2) +5%(9.775) + 30%(6.2) + 13%(8.15) + 8%(10.5) + 5%(10.2) + 1% (19.59) + 2% (0) + 0.5% (14.9) + 2% (14.4) + 1%(7) + 0.5% (6)

Real Inflation = 3.12 + 0.099 + 0.072 +0.48875 + 1.86 + 1.0595 + 0.84 + 0.525 + 0.1959 + 0 + 0.0745 + 0.288 + 0.03

Real Inflation = 8.73365%

So not too far off from real CPI. But what does this mean for you…

Let us bring it back home and understand what the true real inflation rate means for you

Say you earn R15000 a month and you got a R1000 increase for the year and a 13th cheque (bonus).

In 2016 you earned: R180000 + a 13th cheqaue, so R195000, in theory or the fantasy world.

In reality you earned: (R 13276 * 11) + R24152 = R170188

Now let us ask what you will be making in 2017.

That is R192000 + 13th cheque = R 208000.

In reality that is: (14069 * 11) + R25532 = R180291

You can use taxtim to help with your personal income calculations

So by how much has your income increased? It has increased by 5.94%

But to just keep your same lifestyle, even though you have another 1 year of experience at your job and all the skill and expertise that comes with that, you will have needed to earn Your old salary + The real inflation rate of 8.73365%

Meaning just to stay constant your increase should total: R185 051. So to hit this figure bang on you need an increase of R1500 and you need to argue the case with your boss. That means your salary is just staying constant, so it is not an increase.

Now I have also accounted for the increase in the house price as an average of house prices and have not accounted for the primate prime lending rate which is currently at 10.5%. You could use this value as a substitute for the house price increase for a possibly even more accurate value.